Economy

Learn all about FGTS anticipation

Check out how to request your FGTS in advance without having to pay monthly installments and without compromising your budget.

Advertisement

Keep reading to learn more about FGTS anticipation

Applying for FGTS in advance may be the best solution for those who need quick cash. If you need to settle a debt, down payment on an apartment or car, the personal loan secured by the FGTS is the best option.

The anticipation of the FGTS is like a loan that allows you to anticipate your birthday withdrawal by up to 10 years (it may vary depending on the bank). That way, it is not necessary to wait for the month of your birthday to withdraw the amounts from the guarantee fund.

Taking out the loan now, you can receive the amounts within 1 business day and return it with interest to the financial institution.

Do you want to know how to request your FGTS Advance? Read the topics below:

- What is the FGTS;

- How to apply for the FGTS Anticipation;

- How to join the birthday-withdrawal modality;

- Who can apply;

- Requirements.

What is FGTS?

The FGTS (Investment Guarantee Fund) corresponds to 8% of the worker's salary. This amount is deducted from the salary and is deposited every month by the company in the employee's guarantee fund.

The Severance Indemnity Fund is nothing more than the total of these deposits that are deposited by the employer every month. This amount is guaranteed by the CLT and belongs to the employee. However, there are some rules for the worker to withdraw the FGTS.

In the case of FGTS Anticipation, the modality must be “birthday withdrawal”. This type of modality allows the employee to receive a portion of the FGTS every year, in the month of his birthday.

How to apply for FGTS Advance?

Nowadays, more than 70 financial institutions are authorized by Caixa Econômica Federal to make loans available with advance payment of the FGTS as guarantee.

The BMG bank, which is one of the best known banks in Brazil, makes it possible to anticipate the birthday withdrawal by up to 10 years. The personal loan secured by FGTS from BMG bank has a rate of 1.89% per month.

After the request, the amount will fall into the account within 1 business day.

There are other financial institutions that provide this service, such as C6 Bank, Caixa Econômica Federal, Banco do Brasil, Sicredi and Banco Pan.

If you have an account at one of these institutions, you can access the App or the bank's website to carry out a loan simulation. Thus, you are aware of the service conditions (rates and up to how many years you can anticipate).

If you do not have an account at any of these banks, check whether your bank is authorized by Caixa to provide this type of service.

Caixa Econômica Federal points out that to carry out just one loan simulation, it is not necessary to make the change to the birthday withdrawal. This change should only be made when the worker is sure he wants to

How to join the birthday-withdrawal modality?

There are 2 types of modalities for withdrawing the FGTS, they are the anniversary-withdrawal and the termination-withdrawal. When opting for withdrawal-termination, the worker will only be able to withdraw his guarantee fund in full in case of dismissal without just cause.

By opting for joining the birthday withdrawal, it is possible to withdraw part of the FGTS balance annually, in the worker's birthday month.

As we mentioned above, in order to anticipate the values of the guarantee fund, it is necessary that the FGTS modality is for birthday withdrawal.

Don't know how to join this modality? Below we will show you step by step, see:

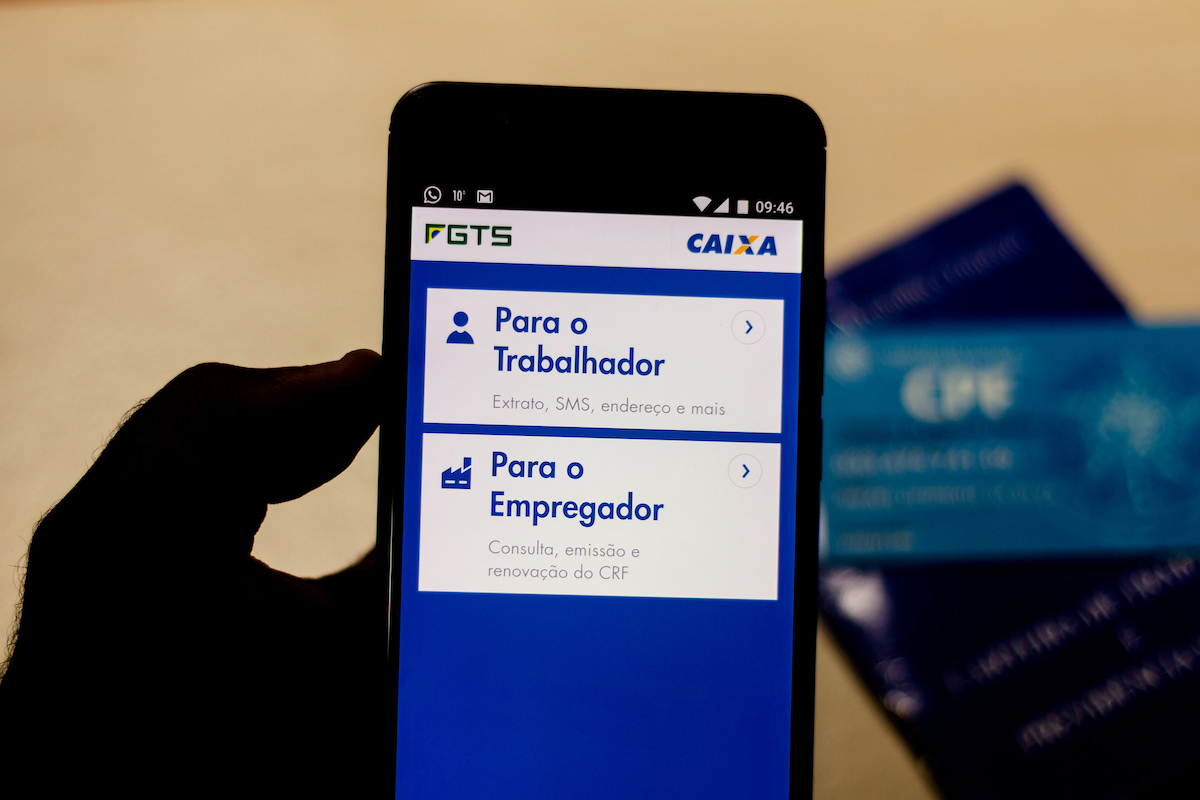

- Download the FGTS App

- If you have an account, please login

- If you don't have an account, you'll need to create one.

- After logging in, click on “Birthday Withdrawal”

- Click on “Opt for Anniversary Cashout”

Ready!

After opting for the birthday withdrawal, the validity will be immediate according to the date on which you opted for the modality.

Who can apply?

Any worker, who has worked under the CLT regime (employed or unemployed), and who has some balance in their active and inactive accounts, may be requesting the anticipation of the FGTS.

Active accounts are the accounts that the current company deposits into every month. Inactive accounts are those where previous employers made the deposit and the amount has not yet been withdrawn.

Requirements

To apply for the loan, there are some requirements that need to be met, check below:

- Be over 18 years of age;

- Have a balance in the FGTS account;

- Have a bank account;

- Allow the financial institution to have access to FGTS data;

- Have your CPF in good standing with the Federal Revenue Service;

- Make the choice for the birthday withdrawal in the FGTS app.

Trending Topics

Step by step to be a Free Market courier

Check out the full step-by-step guide on how to be a Mercado Livre courier here. Register and start earning.

Continue lendo

How to be a Young Apprentice Banco do Brasil

The step-by-step guide to becoming a Banco do Brasil Young Apprentice is here and you cannot miss the chance to work now. Know more!

Continue lendo

Work as a 99 driver – Discover the step by step

Anyone who is a 99 driver is earning more than R$2500 with quick trips and a job without a boss or fixed hours. Understand how it works!

Continue lendo