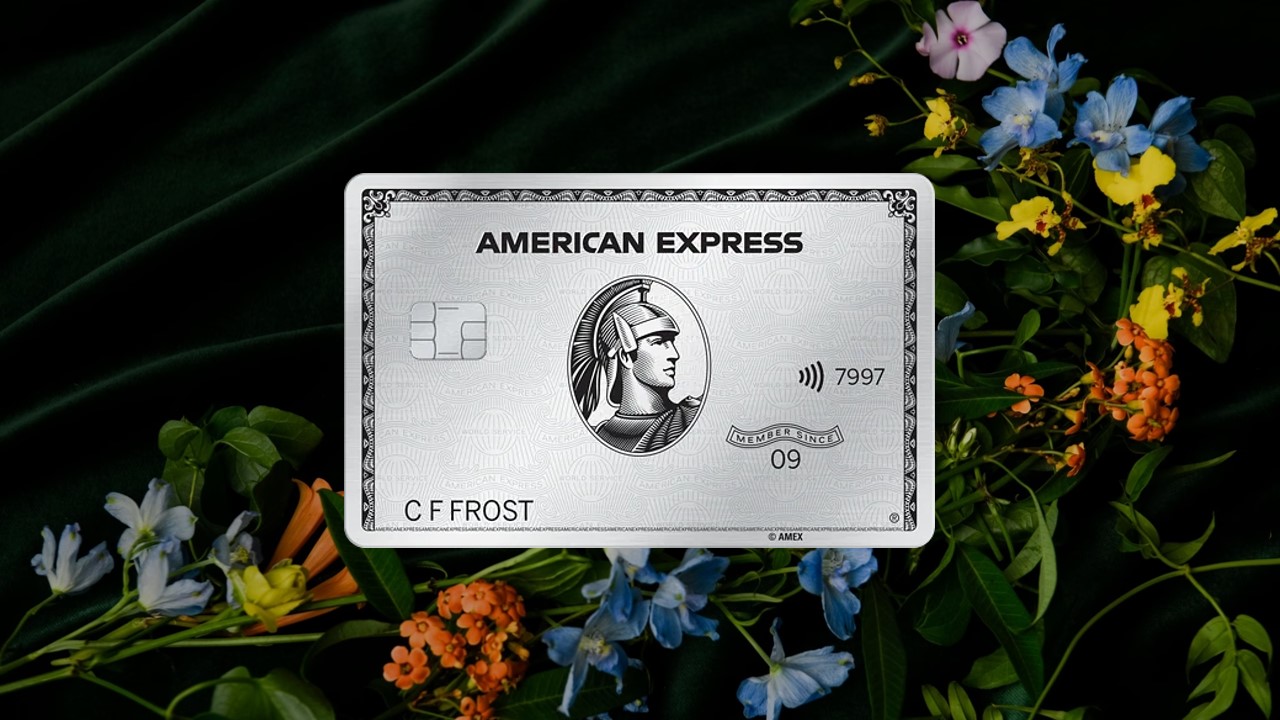

Credit card

The Platinum Card® American Express: Get Over US$ 1,500

Maximize your leisure with $240 digital entertainment credit with The Platinum Card®! Discover how to turn your entertainment expenses into rewards.

Advertisement

Take advantage of the introductory bonus and earn 125,000 reward points with the card!

When you want to apply for a card like The Platinum Card® American Express, several things go through your mind, and they all make complete sense at the moment.

After all, how do you know if the chosen card is good? What to do to request the card? And while all of these questions seem to complicate the process, they can all be answered simply.

If you are the type of person who likes to use more exclusive and extravagant cards, which have more benefits and qualities, then a good card will be The Platinum Card® from American Express.

- Annuity: The annual fee for this card is $695 in total.

- Introductory Bonus: When you spend $8 thousand or more with The Platinum Card® in the first 6 months, you earn 80 thousand reward points. Currently, a promotion is offering 125 thousand points.

- Acceptance of Negatives: The Platinum Card® is currently not accepting customers with a negative credit history.

- Flag: The Platinum Card® operates with its own system, without a specific credit card brand.

- Roof: As a high-quality card, it offers international coverage.

- Other taxes: APR ranging from 21,24% to 29,24%.

- Main benefits: Earn 5x more miles on flights booked directly with American Express or partner airlines. Plus, earn 5x points on hotel bookings through AmexTravel and earn 1 point per dollar on other purchases.

How does The Platinum Card® card work?

Firstly, anyone who knows American Express knows that the company excels at creating high-quality cards.

In fact, this is one of the only cards that offers 5 points when purchasing airline tickets, as long as they are made with The Platinum Card®. Not only that, but the card offers even more points on hotel bookings.

Furthermore, the reservation must be made through The Platinum Card® and the AmexTravel website. With it, you will also receive a point on any other purchase made with The Platinum Card®.

And of course, with all these points accumulated, you can use them to get discounts. When you accumulate a certain amount of points on The Platinum Card®, you can pay for certain purchases using them.

Main features of The Platinum Card® American Express card

The Platinum Card® is the type of card for travelers who like to have more benefits. The main features focus on exactly that, and on the customer's experience when using it.

Thus, the product will do as much as possible to satisfy the customer and try to help as much as possible to obtain the best benefits that a credit card can have.

Benefits

- Points: Earn 5 points when purchasing airline tickets and booking prepaid hotels with AmexTravel. In fact, don't forget that you get 1 point on other purchases.

- Payment Methods: You can pay your monthly bills with The Platinum Card®, pay for purchases in installments and accumulate a balance with interest.

- Travel Benefits: Enjoy $200 hotel, Uber and airline credit, access to the Global Lounge Collection at airports with over 1,400 lounges, international travel program and more.

- Shopping: Enjoy $240 on entertainment, discounts at Walmart, $300 on Equinox, global access to exclusive dining, access to invitation-only events and more.

- Additional Cards: Get an additional card and enjoy The Platinum Card® benefits on all your additional cards.

- Phone Protection: If your cell phone breaks, The Platinum Card® offers help with screen repair, up to a maximum of $800 every 12 months.

- Flexibility: If you make any purchase of $100 or more, you will be able to divide that purchase into more flexible installments and pay when you can.

Disadvantages

- Annual fee: The Platinum Card® has a considerably high annual fee, set at $696.

- APR: The APR (Annual Percentage Rate) for this card is relatively high.

- Minimum Income: To qualify for The Platinum Card®, you must meet a higher minimum income requirement.

What benefits for frequent travelers does The Platinum Card® offer?

Well, The Platinum Card® has an excellent benefits program, Membership Rewards®!

With your program you can earn points just by spending with your card. But, if you buy airline tickets or book hotels, you will earn 5 points.

Furthermore, you can use these points for discounts and win products without paying anything.

How do I apply for The Platinum Card®?

Starting to request a card is very simple, so below we bring you the best way to request The Platinum Card®: via the app, or via the official website! Keep reading.

From the site

Requesting the card via the website is simple. First, just go to the American Express website, search for The Platinum Card® and start applying.

Then, just fill in the requested data. Remembering that you must wait for the bank's decision to find out if you are able to have this credit card.

by the app

To order through the app, simply download it. So, go to the store and search for the app. Then download and create your account.

Once in the app, you go to the credit card area, click on The Platinum Card® and fill out the form.

The Platinum Card® or Capital One Venture Rewards card: which is better for accumulating miles?

Deciding between The Platinum Card® and Capital One Venture Rewards to earn miles? Well, if your focus is simplicity and value, Capital One Venture Rewards is the right choice.

After all, with a lower annual fee and easy miles to accumulate on all purchases, it is perfect for those who want to earn travel quickly, without complications.

Although The Platinum Card® American Express has its luxuries, to earn miles in a practical and economical way, Capital One Venture Rewards wins!

Trending Topics

CRLV Digital – Learn more about how to download the application

CRLV Digital is completely free and offers several benefits to its users. Learn more by reading this article.

Continue lendo

Vueling Airlines: low-cost flights to different countries!

Travel smart with Vueling Airlines, Spain's low-cost airline! Find cheap and flexible flights!

Continue lendo