Automobiles

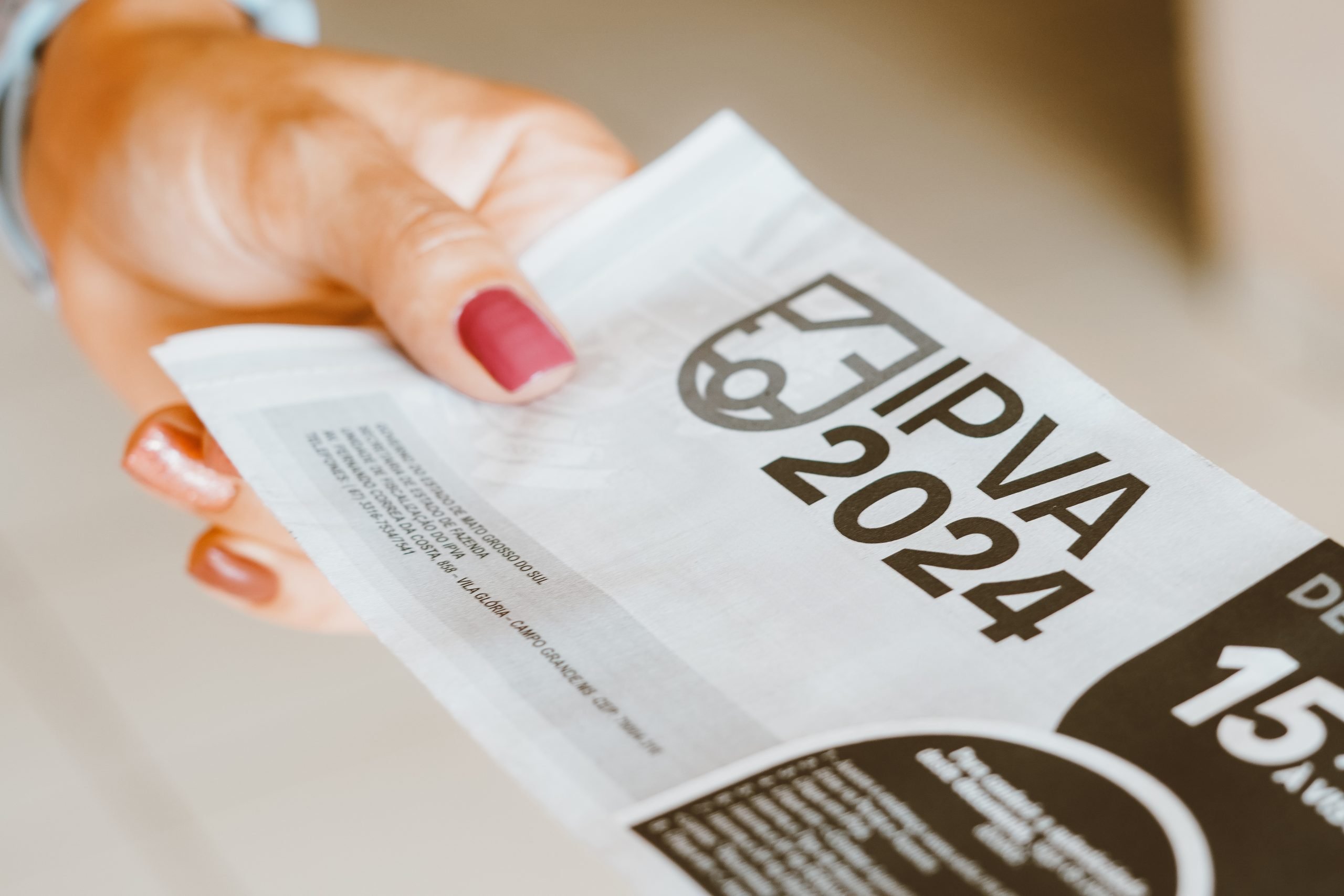

IPVA 2024: details about states and payments!

Tired of being lost when paying taxes for the upcoming year? IPVA 2024 has been a question for many Brazilians. Check out the information we already know!

Advertisement

Discover more information about the 2024 IPVA! Pay without complications!

The time to pay IPVA 2024 is almost here. The end of the year is getting closer and closer, and you need to obtain comprehensive information on the subject to make the payment without problems.

We are here to help as much as possible. Read on to check every detail about paying this tax!

What is IPVA 2024?

IPVA 2024 is nothing more than the tax on vehicle ownership. The acronym literally means Motor Vehicle Ownership Tax.

Furthermore, this tax generated around R$65 billion reais in 2022 alone in Brazil. In other words, it is charged every year!

Which states have information about IPVA 2024?

To date, not all Brazilian states have made information available about the payment of IPVA in 2024.

At the moment, only 15 will be available. Shall we take a quick look at each of them? Come!

Holy Spirit

In the state of Espírito Santo, vehicle owners must pay 2% for passenger cars and 1% for motorcycles, trucks, minibuses and buses.

Furthermore, if you are unable to pay the IPVA 2024 in full at the moment, there is the option of paying in up to 6 installments, available between the months of April and September.

Minas Gerais

Firstly, Minas Gerais is a state where the amount to be paid varies. You will have to pay between 1% and 4% on the value of the vehicle.

Therefore, passenger cars pay 4% on the value of the model, and motorcyclists need to pay 2%.

Meanwhile, other types of vehicles, such as rental companies, buses, trucks and the like, are only charged 1%.

However, the tax will be paid in a single installment with a 3% discount or paid in up to 3 installments in IPVA 2024.

São Paulo

In São Paulo, the IPVA rates in 2024 are slightly higher, reaching 4% for passenger cars, 2% for motorcycles and similar vehicles.

Meanwhile, trucks have to pay 1.5%, while rental vehicles only pay 1%.

Once again, payment must be made in a single installment in January, with a discount of 3%. Additionally, there is the option to pay in up to 5 installments, depending on the vehicle's license plate.

Rio de Janeiro

In the state of Rio de Janeiro, the rate for IPVA 2024 on passenger cars is 4%, and for motorcycles, buses, trucks and similar is 2%.

Electric and hybrid cars powered by natural gas have lower values, with electric cars paying 0.5% and cars powered by natural gas paying 1.5%.

Payment can be made through payment in a single installment with a discount of 3% until January 22nd.

Alternatively, there is the option of paying in up to 3 installments in January, February, March or April.

Paraná

Well, in the state of Paraná, the tax rate for cars is 3.5%, while for trucks and similar vehicles it is 1%.

In addition, there is the option of paying IPVA 2024 in cash, with a discount of 6%, or the alternative of paying in up to 5 installments.

Rio Grande do Sul

Firstly, in Rio Grande do Sul, the 2024 IPVA rates remain the same as the previous year. In other words, cars pay 3%, motorcycles pay 2%, and trucks pay 1%.

Furthermore, payment can be made in a single installment or in installments.

Federal District

In the Federal District, the rates are 3.5% for passenger cars, 1% for trucks and 2% for motorcycles.

If the value of IPVA 2024 is less than R$100, it must be paid in a single installment.

Mato Grosso do Sul

In the state of Mato Grosso do Sul, passenger vehicles pay 3% of IPVA 2024, while trucks, buses and similar pay 1.5%.

Additionally, motorcycles have a tax rate of 2%. If the vehicle has capacity for up to 8 people, excluding the driver, and has a diesel engine, the tax rate is 4.5%.

Thus, payment can be made in cash, in a single installment, with a discount of 15%, or paid in up to 5 installments.

Bahia

Next, we have Bahia where the 2024 IPVA tax rate for any vehicle is 2.5%. Payment can be paid in up to 5 installments, or in a single installment, with a discount of 15% or 8%.

Paraíba

In Paraíba, the IPVA 2024 rate is 1% for cars, motorcycles and similar, and 2.5% for buses and trucks.

Furthermore, payment can be made in a single installment, with a discount of 10%, or paid in 3 installments.

Piauí

In the state of Piauí, the 2024 IPVA rate is 3% for cars with a value above R$150 thousand and 2.5% for others. Motorcycles have a tax rate of 2%, while trucks pay 1%.

Furthermore, payment can be made in cash, with a discount of 15% in January, 10% in February, or in up to 3 interest-free installments.

Sergipe

In Sergipe, the 2024 IPVA rate is 3% for cars with a value above R$120 thousand and 2.5% for others. Motorcycles pay 2%, and buses and similar vehicles pay 1%.

However, if payment is made by March 27th, there is a discount of 10%, or it is possible to pay in up to 10 installments on the card.

Acre

In Acre, passenger cars have a tax rate of 2%, while trucks and similar vehicles pay 1%. Payment in a single installment yields a discount of 10%, or it is possible to pay in up to 3 installments.

For

In Pará, the rate is 2.5% for cars, 1% for buses and similar, and 0.5% for boats and similar. As in other states, payment can be made in a single installment or in up to 3 installments.

If there have been no fines in the last 2 years, there is a discount of 15%; if it is in the last year, the discount is 10%; and if there are fines in the last 2 years, the discount is 5%.

Roraima

Therefore, in Roraima, the rate is 3% for passenger vehicles, 2% for transporting cargo, motorcycles or other vehicles, and 1% for rental vehicles.

So, paying IPVA 2024 in cash by February 29th guarantees a discount of 10%, or it is possible to pay in 3 installments.

Tocantins

Finally, in Tocantins, the 2024 IPVA rate is 2% for cars, 3% for trucks and utility vehicles, and 1% for motorcycles.

Finally, payment can be made in a single installment or in up to 10 installments, with each installment not being less than R$500.

See also: cheaper vehicles up to 25%!

In addition to understanding the value of the IPVA in 2024, how about thinking about changing your car to an even newer model?

So know that tax cuts have made vehicles cheaper to buy! Understand more about the subject below!

Trending Topics

Online barber course: See how to sign up for free

Want to become a barber but don't know where to start? So, discover the barber course on the Edutin Academy platform.

Continue lendo

EasyFly discount tickets: find out how to find them!

Discover the application full of discounts and exclusive promotions from EasyFly, and enjoy an economical trip without compromising quality!

Continue lendoYou may also like

Copa Airlines: flights across the Americas at affordable prices

Copa Airlines is Panama's low cost airline offering competitively priced flights to dozens of countries across the Americas!

Continue lendo

Immediate Openings in Housekeeping – Complete Career Guide

Find out how to enter the cleaning industry with immediate job vacancies! Learn about benefits and key tips for career growth. Check it out now!

Continue lendo