Automobiles

IPVA 2023: discounts, amounts and payment schedule

After the joy of the end-of-year festivities, new tax payment calendars arrive, such as IPVA, for example. Check out the article below and stay up to date with all the details.

Advertisement

The IPVA (Motor Vehicle Ownership Tax) is a tax instituted in 1986 and is charged in all states of the federation, in addition to the Federal District.

From the tax collected, 20% is destined for Fundeb (Basic Education Maintenance and Development Fund).

The remainder of the amount is distributed equally between the municipality and the state in which the vehicle is licensed.

It is worth mentioning that the IPVA is a mandatory tax, and non-payment can generate a series of tax and administrative sanctions for the vehicle owner.

How do I know the IPVA value of my car?

It is important to know that the value of the IPVA is defined by the value of the vehicle, differing according to the year of manufacture, brand and model.

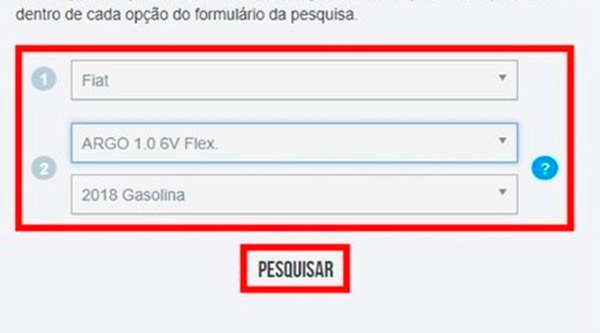

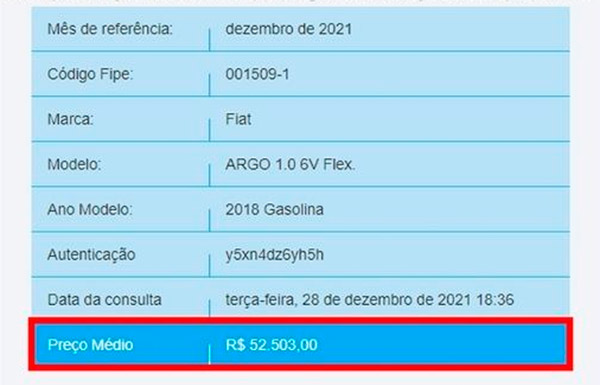

The value is measured by the Fundação Instituto de Pesquisas Econômicas, according to the table known as the Fipe Table (https://veiculos.fipe.org.br).

Below you can see a complete step-by-step guide to carrying out your value query on the Fipe Table and then calculating the value of your IPVA.

Each state has its own rate, which is used on the value of the vehicle to generate the value of the IPVA itself. These rates can vary from 2% to 4%.

It is worth noting that in addition to the IPVA amount, the taxpayer must pay the licensing fee, which is collected for the state's DETRAN, in addition to the DPVAT (Mandatory Insurance for Personal Damage Caused by Vehicles).

Discounts and payment schedule

Just like the amount, the IPVA payment date will vary according to the state, with each state having its own schedule.

The dates are progressive according to the final number on the plate (from 1 to 0), and include both installments in up to 5 installments, as well as payment in cash, in which case a discount is normally given to the taxpayer.

Discounts average 3%, but there are states that can give higher discounts, reaching up to 9% of the tax value.

It is important that each taxpayer checks the table in their state, in order to avoid delays in payment that can generate interest and fines, which ends up increasing the tax amount even further.

After all this information, check your budget and see which option is most viable for you.

What is the IPVA?

The IPVA (Tax on Motor Vehicle Ownership) is a tax instituted in 1986 and charged in all states of the federation, in addition to the Federal District.

It is a Brazilian tax that is levied exclusively on vehicle ownership, not on vessels and aircraft.

It is a state tax, that is, only the States and the Federal District have the competence to institute it in accordance with article 155, III of the Federal Constitution.

The rate used as a reference is determined by each state government, based on its own criteria. The calculation basis is the market value of the vehicle, established by the State that collects the referred tax.

In 2017, the states that charged the highest rates were São Paulo, Rio de Janeiro and Minas Gerais, with 4% on the market value of the vehicle, while other states have their rate varying between 1% and 3%.

From the tax collected, 20% is destined for Fundeb (Basic Education Maintenance and Development Fund).

The remainder of the amount is distributed equally between the municipality and the state in which the vehicle is licensed.

It is worth mentioning that the IPVA is a mandatory tax, and non-payment can generate a series of tax and administrative sanctions for the vehicle owner.

Trending Topics

Mercado Livre Delivery Jobs – Earn up to R$240 per day

Are you looking for a job offer that gives you a good income and flexible hours? Learn how to be a Free Market courier.

Continue lendo

Saudia: flights + hotels in one place!

Do you intend to take a trip to the Middle East? Saudia offers promotional flights to different continents such as Asia, Europe and America!

Continue lendoIdeal resume to work as a telemarketer

Understand how to make the ideal resume for a telemarketer and celebrate a new job vacancy. See it all!

Continue lendoYou may also like

Discover Job Vacancies SINE – public employment program

Take advantage of the sine job openings and start the year off on the right foot in the job market. Check out how it all works!

Continue lendo

Latam app: your gateway to an unforgettable trip!

Elected the best airline in South America, flying with Latam Airlines is a guarantee of safety, quality and comfort.

Continue lendo