Economy

FGTS anticipation – Find out what it is and how to request it

The FGTS Anticipation has already helped thousands of people across the country. Want to know how to apply? We separate everything you need to know to anticipate your withdrawal. Check out.

Advertisement

Keep reading to find out what “Anticipating the FGTS” is

The loan guaranteed by the guarantee fund is like a credit that makes it possible to advance up to 10 years of the amount of the birthday withdrawal. Thus, the person does not have to wait for the month of their birthday to withdraw.

Anticipating the FGTS withdrawal can be one of the best solutions for those who need quick cash and it is a new way to take out a loan and receive a significant amount quickly and safely.

By opting for this modality, your FGTS balance will be given as guarantee and the debt payment is deducted from this fund every year, in the month of your birthday.

This is one of the best options for those who need cash on hand, either to pay off debts or to pay down payments on a car or house.

You will not compromise your family budget, as it will not be necessary to pay installments, as with other types of loans.

In addition, the FGTS amount is yours and you are entitled to receive it.

Do you want to know how to request your FGTS Advance? Read the topics below:

- The best banks to carry out FGTS Anticipation;

- Requirements to Anticipate the FGTS;

- It is worth asking for the FGTS Anticipation;

- Anniversary Loot – what is it?

The best banks for you to make the FGTS Anticipation

We will now list the best banks for you to request the Anticipation of your guarantee fund. Compare each one and choose the best one for you!

1) BMG Bank

Banco BMG is one of the best known banks in the country. Currently, it makes it possible to anticipate the anniversary withdrawal by up to 10 years.

For those who are already BMG customers and want to make the request, just access the bank's application and request it. Anyone who is not yet a customer and wants to anticipate the FGTS with BMG, it is necessary to access the bank's website, or if you prefer, contact the bank through the whatsapp number that they inform on the website.

The FGTS loan from the BMG bank has a rate of 1.89% per month. After the request, the amount falls into the account within 1 business day.

2) C6 Bank

C6 Bank is a very competitive digital 100% bank and one of the biggest in the current market. On C6, you can claim up to 10 years of the anniversary withdrawal and the interest rates are above 0.99% per month.

If you are interested, you can request the service through the official website of C6 bank.

3) Box

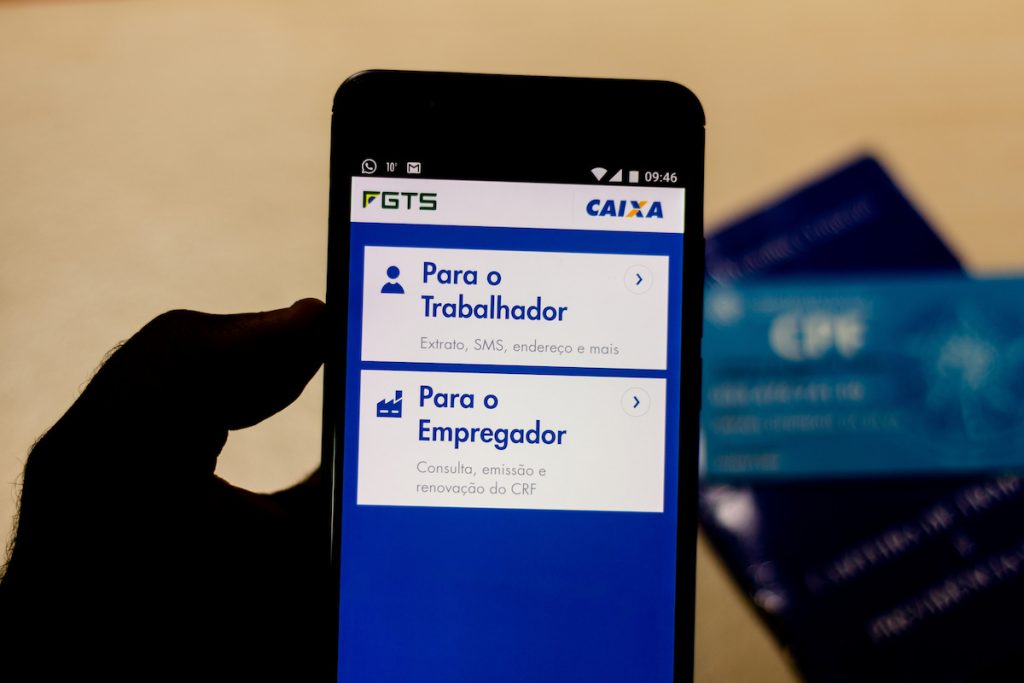

Without a doubt, Caixa is one of the most traditional banks in the country. To request a FGTS withdrawal from Caixa, you must have the birthday withdrawal modality active and you must authorize the bank to consult information related to your FGTS and be in good standing.

Caixa allows you to advance up to 5 years of the anniversary withdrawal, and the minimum amount available for withdrawal is R$500.00.

Now all you have to do is choose your preferred bank and request your FGTS in advance!

Requirements to Anticipate the FGTS

Requesting the FGTS Anticipation is simple, but it is necessary to fulfill some requirements. Check it out below:

- Have a balance in the FGTS account;

- Opt for the birthday withdrawal in the FGTS app;

- Have an active bank account;

- Allow the financial institution to have access to FGTS data;

- Be over 18 years of age;

- Have your CPF in good standing with the Federal Revenue Service.

Is it worth asking for the FGTS Anticipation?

We know that many people need quick cash and if you have a balance in your guarantee fund account, the personal loan secured by the FGTS is the best solution! Check out the main advantages of this type of loan:

- Fast money even for negatives;

- Hiring 100% online;

- Without consultation with the SPC and SERASA;

- Highly competitive interest rates;

- Does not compromise the family budget;

- Account balance within 1 business day.

Yes, it's really worth it!

Anniversary Loot – what is it?

Withdrawal Birthday is a FGTS modality that allows the worker to withdraw from his guarantee fund every year, in the month of his birthday. These amounts that are available for the guarantee fund can be from active or inactive accounts.

When you opt for the birthday withdrawal, it is not allowed to withdraw the entire amount available in the account, only a portion. This part will be defined according to the amount in the account. The larger the account balance, the smaller the amount available for withdrawal.

To set the Withdrawal-Birthday modality, you can access your account on the FGTS App or through Caixa's FGTS website.

Trending Topics

Skyscanner offers tickets from R$59.99

Discover the great deals on Skyscanner tickets and secure your next trip for prices starting at R$59.99. Check out the opportunity!

Continue lendo

Over 10,000 job openings to earn from R6,000/month

Learn how to apply like an expert on South Africa's top job sites. Find open positions and get essential tips to speed up your hiring process!

Continue lendo

Travel with Vistara and join the club for extra discounts!

Your journey begins with Vistara! Enjoy smooth flights, high-quality entertainment and incredible service.

Continue lendoYou may also like

Work as an Ifood delivery man: Don't miss this opportunity

Do you want to work without worrying about schedules and earn up to more than R$2,000 per month? Learn how to become an Ifood partner delivery man.

Continue lendo

How to download Google Files and free up space on your phone

Delete all unnecessary files and have more space on your phone with Files by Google! Check out how to download and start using!

Continue lendo

Iberia Airlines: promotions with different stopovers!

Travel to more than 40 countries around the world in a safe and comfortable way with Iberia flights! Economic rates and superior quality!

Continue lendo